There are signs things are getting better on the inflation front. And yet signs that things are getting worse on economic front.

This contradiction creates a very confusing gumbo for investors to digest. And likely explains why we continue to teeter on the edge of bear market territory at 3,855.

Let’s talk about these competing themes and how it has created 2 different scenarios for the stock market outlook. One bullish and one bearish.

Market Commentary

Let’s start with the Fed’s game plan as clearly spelled out in Chairman Powell’s Jackson Hole speech in August:

- This is a long-term battle to get inflation back to 2% target

- Do NOT expect lower Fed rates through 2023

- Expect “economic pain” which was further described as below trend growth and a weakening of employment.

Now let’s remember that this speech quickly sobered up investors who were enjoying a 18% summer rally up to 4,300 for the S&P 500 (SPY). A month later we were making new lows below 3,600.

The Fed cherishes clarity and consistency in their communication. And thus, I say that any investor who thinks there will be a meaningful change in policy announced Wednesday, only a couple months after the Jackson Hole speech, is smoking something that is still quite illegal.

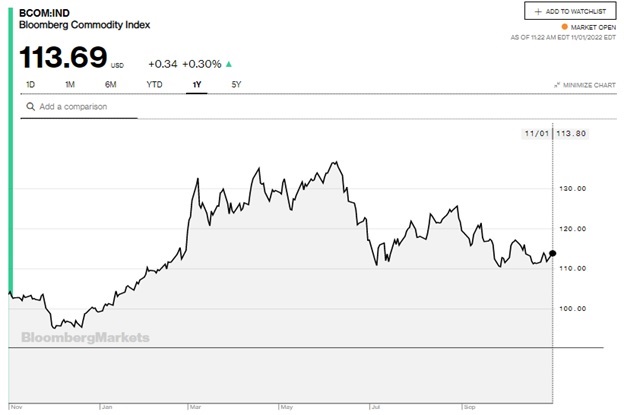

Yet bulls do have some things to cheer such as clear signs of moderating inflation. Almost every key commodity is well off their highs this year. The Bloomberg Commodity Index shows the price trend improving.

This moderation of inflationary pressures is what is behind the hope the Fed will not raise rates as aggressively in the future…and thus would create less damage to the overall economy. This has some folks calling bottom leading to the strong October rally (and hopes for beginning of new bull market).

On the other hand…

Continue reading at STOCKNEWS.com