Shares of AMC Networks Inc. (NASDAQ:AMCX – Get Free Report) have been given an average rating of “Hold” by the three brokerages that are presently covering the stock, Marketbeat.com reports. Two investment analysts have rated the stock with a sell rating and one has assigned a strong buy rating to the company. The average 1-year target price among analysts that have issued a report on the stock in the last year is $8.50.

Shares of AMC Networks Inc. (NASDAQ:AMCX – Get Free Report) have been given an average rating of “Hold” by the three brokerages that are presently covering the stock, Marketbeat.com reports. Two investment analysts have rated the stock with a sell rating and one has assigned a strong buy rating to the company. The average 1-year target price among analysts that have issued a report on the stock in the last year is $8.50.

A number of brokerages recently weighed in on AMCX. Seaport Res Ptn upgraded AMC Networks from a “hold” rating to a “strong-buy” rating in a report on Tuesday, October 22nd. StockNews.com raised AMC Networks from a “hold” rating to a “buy” rating in a research note on Monday, November 11th. Finally, Morgan Stanley dropped their target price on shares of AMC Networks from $10.00 to $9.00 and set an “underweight” rating for the company in a research report on Tuesday, November 12th.

Get Our Latest Stock Report on AMCX

Hedge Funds Weigh In On AMC Networks

AMC Networks Price Performance

Shares of NASDAQ:AMCX opened at $8.95 on Friday. The company has a market cap of $394.88 million, a P/E ratio of 14.21 and a beta of 1.32. The business has a fifty day simple moving average of $9.34 and a 200-day simple moving average of $9.28. AMC Networks has a 52 week low of $7.08 and a 52 week high of $19.39. The company has a quick ratio of 2.32, a current ratio of 2.32 and a debt-to-equity ratio of 2.03.

AMC Networks (NASDAQ:AMCX – Get Free Report) last posted its quarterly earnings data on Friday, November 8th. The company reported $0.91 EPS for the quarter, beating analysts’ consensus estimates of $0.62 by $0.29. AMC Networks had a net margin of 1.45% and a return on equity of 17.41%. The company had revenue of $599.60 million during the quarter, compared to the consensus estimate of $587.12 million. During the same quarter in the prior year, the company posted $1.85 EPS. The company’s quarterly revenue was down 5.9% compared to the same quarter last year. Equities research analysts forecast that AMC Networks will post 4.09 EPS for the current year.

About AMC Networks

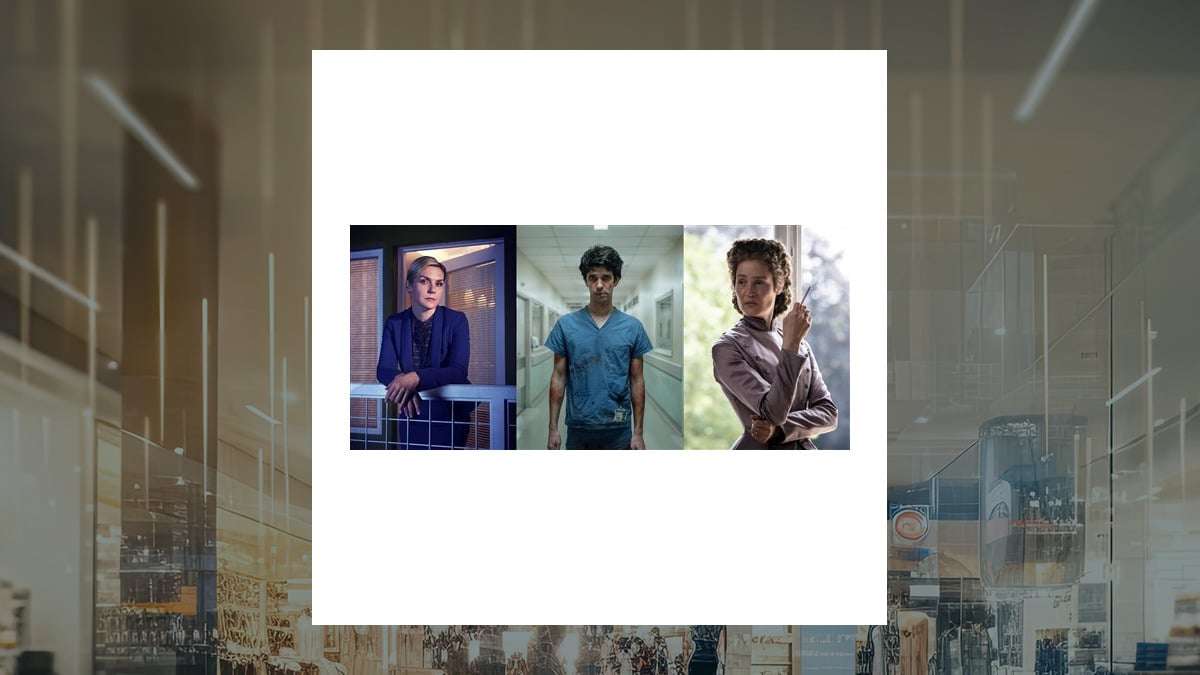

AMC Networks Inc, an entertainment company, owns and operates a suite of video entertainment products that are delivered to audiences, a platform to distributors, and advertisers in the United States, Europe, and internationally. The company operates through Domestic Operations, and International and Other segments.

Featured Stories

- Five stocks we like better than AMC Networks

- 3 Dividend Kings To Consider

- ServiceTitan Made Waves in Its IPO, But Is the Stock a Buy?

- Stock Ratings and Recommendations: Understanding Analyst Ratings

- Netflix: Is This the Perfect Time to Buy a Streaming Powerhouse?

- Uptrend Stocks Explained: Learn How to Trade Using Uptrends

- Goldman Sachs Unveils 3 Massive Opportunities for 2025 Investors

Receive News & Ratings for AMC Networks Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for AMC Networks and related companies with MarketBeat.com's FREE daily email newsletter.